As we gear up for the end of the tax year in the UK, it’s time to dive into some savvy tax year-end financial planning. In this no-nonsense guide, we’ll spill the beans on strategies to max out your financial gains before the tax year curtain falls.

First things first, start rounding up all those financial docs – your income statements, receipts, the whole shebang. Trust us, getting organised now will save you from last-minute panic attacks before the April 5th deadline.

Imagine you’re a freelancer hustling hard. By keeping all your business receipts and invoices in check, you’re not just making tax time less stressful, but you might uncover some extra expenses to write off.

Tax year-end financial planning

Understanding Key Tax Deadlines

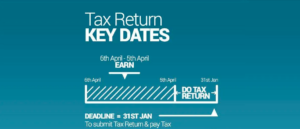

Let’s get real about deadlines. Mark that calendar and set those reminders – January 31st is the day for online tax returns and payments, and if you’re still rocking the paper returns, while paper returns have an earlier deadline of October 31st.

Picture yourself setting up reminders on your phone. That way, you won’t be scrambling last minute and risking missing out on the online deadline. Think about someone who’s got their January 31st deadline circled in red on their calendar. With a simple reminder, they avoid late fees and enjoy a smooth tax season.

Now, while you’re at it, take a moment to check in on your overall money game. Maybe it’s time to tweak that budget or set some new financial goals.

Use this time to assess your overall financial health. Consider creating or updating your budget, reviewing your financial goals, and identifying areas for improvement.

Reviewing Income and Expenses

Let’s talk about income and expenses. Hunt down those deductible business expenses like a tax-savvy detective. We’re talking work-related travel, professional subscriptions – the works.

If you’re a small business owner scanning through your expenses, finding those sneaky deductible items not only saves you money but also keeps the taxman off your back.

Speaking of which, now’s a good time to reassess your spending. Cut back where you can and think about how those savings can work for you.

Evaluate your spending patterns and explore opportunities to cut unnecessary expenses. Redirect the saved funds toward savings or investments to bolster your financial future.

Maximising ISA Contributions

Time to chat about ISAs, your secret weapon for tax-efficient savings. Check your contributions and, if there’s room, top this up before the April 5th hits. Remember – the limit each year is currently set at £20,000. Once the 6th April hits, the allowance re-starts.

Imagine you’re checking your ISA contributions and realising you’ve got room to spare. By maxing it out, you’re making sure your savings grow tax-free.

A smart investor spreads their ISA investments across stocks and bonds. It’s not just about saving on taxes; it’s about building a well-balanced, tax-efficient portfolio.

While we’re on the topic, think about how your ISAs fit into your overall money goals. Diversify your investments, and you’ll be golden.

Capital Gains Tax Strategies

Time to tackle capital gains tax. Sell those winning assets but be strategic – balance it out by selling some losers too. And hey, don’t forget the January 31st deadline to pay any tax from the previous tax year.

The capital gains tax ‘annual exempt amount‘ is the maximum profit you can make on selling or disposing of assets without paying capital gains tax. The allowance is £6,000 for the 2023/24 tax year, slashed from £12,300 in 2022/23. This is reducing further in the 2024/25 tax year to £3,000.

If you’ve made significant profits from selling assets during the year, consider selling assets with losses to offset the gains and reduce your overall capital gains tax liability.

Picture yourself selling off those assets with a juicy profit. But here’s the twist – you’re also selling off some underperformers to offset the gains and save on taxes.

An investor, savvy as ever, rethinks their portfolio. By selling off some assets with losses, they not only minimise taxes but also keep their investments in check.

Take a deep dive into your investment portfolio. Maybe it’s time for a refresh, align it with your risk tolerance, and keep those long-term goals in mind.

Pension Contributions

Let’s talk pensions. Beef up those contributions for some additional tax relief. Remember, the deadline to claim tax relief on pension contributions is when the tax year wraps up.

There is an annual allowance which limits the amount someone can pay into pension schemes each year before they must pay tax, which is £60,000 in the 2023/24 tax year. The annual allowance is tapered (reduced) for higher earners. It is reduced by £1 for every £2 someone earns over £260,000 (including pension contributions).

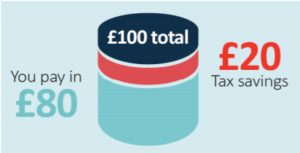

Imagine increasing your pension contributions – not only are you setting up a cosy retirement, but you’re also snagging some tax relief along the way. This is because personal pension contributions are grossed up by your marginal income rate.

So, if you’re a higher rate taxpayer, 40% is added to your pension pot for each contribution made (for every £100, £40 is added). The first 20% is added automatically, while the other 20% being claimed via self-assessment.

It’s not just about tax breaks; it’s about securing a worry-free future.

While you’re at it, reassess those retirement goals. A little adjustment here and there, and you’ll be sailing smoothly into your golden years.

Inheritance Tax Planning

Time to crack the code on inheritance tax. Get strategic with gifting assets within the limits. And yes, update those wills and estate plans – it’s not just paperwork; it’s peace of mind.

Everyone will have a Nil-rate band (NRB) which is an amount of your estate which can be passed on to your beneficiaries free from inheritance tax (IHT) after death.

There is also a “Residence Nil Rate Band” (known as RNRB) which is an inheritance tax free allowance currently set at £175,000. Broadly, RNRB will be available if a person’s estate includes their home, and it is left to their children or other direct descendants. The legislation refers to property being ‘closely inherited’. The amount of RNRB available is limited to the value of the home that is left to the direct descendants.

The RNRB of £175,000 (where available) is in addition to the £325,000 IHT nil-rate band. Further to this, if you’re married or in a civil partnership and your estate is worth less than your threshold, any unused threshold can be added to your partner’s threshold when you die.

Picture a family strategically passing on assets within the allowable limits. It’s not just about saving on inheritance tax; it’s about making sure your wealth stays in the family.

Dive deep into your estate planning. Explore trusts and other strategies to safeguard your wealth and make sure it’s working for you.

Utilising Tax-Efficient Investments

Let’s talk tax-efficient investments – Venture Capital Trusts (VCTs) and Enterprise Investment Schemes (EIS). These aren’t just investments; they’re tax-savvy moves. But remember, know those deadlines!

The big thing EIS and VCTs have in common is that they both offer up to 30% upfront income tax relief to investors. This means you can claim 30% of the value of an investment off your income tax bill, provided you keep your shares for at least three years and five years respectively.

Imagine diving into VCTs or EIS, knowing that not only are you potentially getting returns, but you’re also enjoying some amazing tax benefits.

Diversify those investments. Think about how different options align with your goals, and always keep an eye on the tax implications.

Tax Credits and Benefits

Time to cash in on tax credits and benefits. Don’t sleep on these – claim what you’re entitled to, whether it’s the Marriage Allowance or Working Tax Credit.

Picture yourself claiming all those tax credits – Marriage Allowance, Working Tax Credit, you name it. It’s not just about saving on taxes; it’s about putting more money back in your pocket.

By claiming it, you’re not just reducing their tax bill; they’re freeing up cash for your financial goals.

Charitable Giving for Tax Relief

Let’s get generous – charitable donations can be a win-win. Give to a cause you love, and, oh yeah, and of course some additional tax relief. Just keep those receipts handy.

Imagine making a generous donation to your favourite cause. Not only are you doing good, but you’re also snagging some tax deductions. Again, make sure you’ve got the receipts to prove it.

Utilising Marriage Allowance and Other Reliefs

Let’s dig into some lesser-known reliefs, like Marriage Allowance. If you’re part of a couple, consider shifting that personal allowance around.

Picture a couple playing the tax game smart. By moving part of the personal allowance between them, they’re not just saving on taxes; they’re optimising their overall financial situation.

Conclusion

So, there you have it – a roadmap to ace your end-of-year tax game. Start putting these strategies into play now, and you’ll be cruising through tax season with confidence. Remember, deadlines matter, so take action early for a smooth and tax-efficient year-end.

Book in a consultation here