Financial Planning for Academy Players: A Guide for Ages 16-18.

Becoming an academy-level football player

Being an academy player in any sport is a dream come true for many aspiring athletes. However, it’s essential to recognise that a professional football career is often short-lived, and the financial stability of players largely depends on how they manage their earnings during the early years.

In this article, we will discuss what academy football players need to think about from the ages of 16 to 18 in terms of their finances, including saving and investing for the future, managing increased earnings, pre-contract agreements, image rights, and agency fees.

Good financial Planning is of course essential in ensuring that athletes don’t go bankrupt, and are able to sustain their lifestyles for the rest of their lives.

Saving and Investing for the Future

Here are just a few ways you can successfully build your levels of wealth for your future. Your future self will thank you for this.

Establish a Financial Foundation

From the age of 16, it’s crucial to begin building a solid financial foundation. Open a bank account, create a budget, and develop good financial habits.

Emergency Fund

Save a portion of your earnings for an emergency fund. This safety net can help you handle unexpected expenses without going into debt.

We normally recommend 3 – 6 times your total monthly costs in an easy to access cash or savings account. This is of course unique to everyone, and people should bear in mind how much they might need in an emergency before you even consider investing your earnings.

Consider Long-Term financial Goals

Start thinking about your long-term financial goals. This might include buying a home, further education, or starting a business.

Goal setting is one of the most important factors when considering financial planning for academy players, and helps set the path for the most suitable actions to take.

Diversify Investments

Begin learning about various investment options, such as stocks, bonds, and real estate. Consider working with a financial advisor to determine the best investment strategy based on your risk tolerance and goals.

With investing, diversification is key. Don’t have all your eggs in one basket.

Markets are very cyclical, meaning that certain asset classes do well in certain environments, and often are negatively correlated to one another (Equities and Bonds for example). Be mindful of this when selecting your investments so that you can effectively ‘weather the storm’ if and when markets do fall.

Set Financial goals

Set specific financial goals, both in the short-term and long term. These might include saving for retirement, buying a house or funding your post-football career education.

Goals should ‘SMART”.

S – Specific

M – Measurable

A – Achievable

R – Relevant

T – Time Bound

Avoid ‘lifestyle inflation’

Avoid the temptation to immediately upgrade your lifestyle with large income increases. Instead, focus on saving and investing for the future.

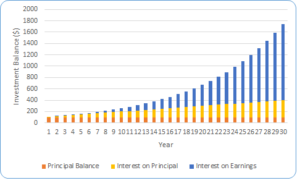

Compound interest and investments

Compound interest is the concept of earning interest on interest.

It’s often states that it’s the “Eighth wonder of the world. He who understands it, earns it; he who doesn’t pays it”.

The last part of this sentence is in the context of credit card debt.

Interest that compounds against you will cost you money.

For savings, it can make you richer.

For investing it can make you a lot richer.

Remember this when saving for your future. This can go a long way in creating significant levels of wealth once you’re older.

Manage debt

Minimise and manage debt responsibility. Avoid high-interest loans or credit card debt.

Consider consulting a financial adviser for debt management strategies.

Remember – with compound interest, debt works against your levels of wealth.

Investments work for you.

Pre-Contract Agreements, Image Rights, and Agency Fees

Legal Counsel

A pre-contract is an agreement between a player that club that commits to a move being made once the player’s current deal comes to a close. Talks can be opened up to six months before the expiration of a previous agreement in alternative surroundings.

When negotiating a pre-contract agreement, always seek legal advice to understand the terms and ensure they are favourable.

Image Rights (IRCs)

Image rights can be a significant source of income. Work with professionals to manage these rights and protect your brand.

In the words of HMRC, images rights are “a bundle of intellectual property rights that derive from the expression of an individual’s name, likeness, voice, logo, signature, initials or anything else that is readily recognisable”.

These image rights enable a player to exploit their likeness for commercial value via the sponsorship agreements and endorsement activates of other companies.

Because image rights companies (IRCs) are set up as a Limited Company structure (Ltd) they will be taxed differently to how you as an individual player will be taxed. This means that payments will be subject to corporation tax, rather than income.

Corporation tax rates are currently set at 19% for profits under £50,000 and 25% for profits over £250,000.

Income tax rates are set within the following bands:

| Band | Taxable income | Tax rate |

| Personal Allowance | Up to £12,570 | 0% |

| Basic rate | £12,571 to £50,270 | 20% |

| Higher rate | £50,271 to £125,140 | 40% |

| Additional rate | over £125,140 | 45% |

Depending on the deal and how much these image rights are going to make the player, it might therefore be worthwhile setting up a Ltd company due to the lower tax rates on offer.

It’s also worth noting that dividends (income taken from the companies’ profits) also come with their own tax rate. In the tax year 2023/24 dividends are taxed at 8.75% for basic rate taxpayers. 33.75% for higher rate taxpayers. 39.35% for additional rate taxpayers.

Agency Fees:

Negotiate agency fees upfront and understand the terms of the contract with your agent. Ensure the fees are reasonable and align with industry standards.

It’s important to note that if the club pays the agents fees, then the player will be taxed on the benefit-in-kind (a non-cash benefit) that the club has provided to the player, by settling 50% of the agent’s fee on their behalf. In the UK at least, these fees are deemed to be 50% for the agents work representing the club, and the other 50% for representing the player.

The benefit which is provided to the player is the agents fee paid, plus the VAT charged. This is then added to the players P11D from the club.

The alternative might be for the club to pay the athlete an additional salary (which they will be taxed on) with the player making the onward payment to the agent.

Some of the big players (those with good accountants at least…) have started to negotiate a loyalty bonus payable in January that covers the tax they have to pay on their agent’s fees for the previous tax year.

Tax is obviously also payable on this bonus, so the club need to gross up the payment to give the player the net amount they need to settle the tax bill.

Preparing for Life after the Scholarship agreement

Preparing for life after the scholarship agreement is crucial for academy football players in the UK. The reality is that only a small percentage of academy players go on to have professional football careers.

Here are some key steps and considerations for these young athletes:

Transition Planning

The scholarship agreement typically lasts for two years. Use this time to prepare for life beyond the academy. Explore educational opportunities, vocational training, or other career paths.

Develop Marketable Skills

Alongside your football training, acquiring additional skills or qualifications can make you more versatile and employable in other fields.

Network and Mentorship

Connect with professionals in and outside the football industry. Mentors can provide guidance on your career transition and financial planning.

Salary Negotiation

Once you sign a professional contract after your 18th birthday, be cautious about your first big payday. Consider seeking advice from a financial advisor or agent before finalizing the deal.

Living within your means

Avoid extravagant spending. Living within or below your means can help ensure your financial security in the long run.

Education and Qualifications

While focusing on football, don’t neglect your education. Ensure that you complete your secondary education and, ideally, attain further qualifications.

Consider pursuing vocational qualifications or an academic degree as a backup plan. Many players combine their education with football training through online courses or evening classes.

Career Planning

Start thinking about potential careers beyond football. What interests you? What skills do you have or want to develop? Seek career advice and counselling if needed.

Explore part-time work or internships in areas that interest you. This can help you gain experience and build a professional network.

Financial Management

Learn about personal finance and develop strong financial habits. Create a budget, save money, and invest wisely.

Build an emergency fund to cover unforeseen expenses, which can help avoid financial strain during career transitions.

Networking

Establish connections outside of football. Attend industry events, engage with professionals, and seek mentors who can provide guidance and advice.

Networking can open doors to various career opportunities and help you transition more smoothly.

Skills Development

Identify transferable skills from your football career, such as teamwork, leadership, discipline, and time management. These qualities can be valuable in other professions.

Consider enrolling in courses or workshops that can enhance your skills and make you more appealing to potential employers.

Mental Health and Wellbeing

Focus on your mental health and wellbeing. The transition from football can be challenging, and it’s essential to maintain a healthy state of mind.

Seek support from a sports psychologist or counsellor if needed, as they can help you cope with the emotional aspects of this transition.

Stay Fit and Active

Maintain your physical fitness even if you’re not pursuing football professionally. Staying active is important for your overall health and wellbeing.

Seek Guidance

Don’t hesitate to reach out to career counsellors, mentors, and former players who have successfully transitioned into other careers.

Use available resources, such as the Professional Footballers’ Association (PFA), which can provide support and guidance for players transitioning out of the game.

Consider Coaching and Off-Field Roles

Coaching and other off-field roles within the football industry are viable career options. Consider acquiring coaching qualifications and gaining experience in these areas.

Utilise Government Programs

In the UK, there are government-funded programs and initiatives that provide support for career development and education. Research and take advantage of these resources.

Remember that a career in football doesn’t have to be the only path to success. By taking these steps and preparing for life beyond your scholarship agreement, you can increase your chances of a successful and fulfilling career outside of the sport.

It’s important to be proactive and plan for the future to ensure a smooth transition when the time comes.

Conclusion

Academy-level football players between the ages of 16 and 18 must proactively manage their finances to secure their financial future. Robust Financial Planning for academy players will help athletes by saving, investing wisely, and preparing for life after the scholarship agreement, they can set themselves up for success both on and off the field.

Additionally, understanding the nuances of pre-contract agreements, image rights, and agency fees is crucial to protect their interests and maximize their earnings. With proper financial planning, young football talents can ensure a more secure and prosperous future.