The Playbook for Financial Success: How Professional Athletes can Leverage the 1% Rule

Introduction

In the high-stakes world of professional sports, financial stability is a game-changer.For professional athletes, mastering the art of financial management is as crucial as perfecting their skills on the field.

Enter the 1% rule, a strategy that’s not just a financial compass but a playbook for building lasting wealth.

In this post, we’ll show how professional athletes can leverage the 1% rule by exploring its applications in real estate, budgeting, investment portfolios, and long-term financial planning, all tailored for the unique journey of professional athletes.

Plus, we’ll uncover the magic of compound interest over a 10-year period and see how it amplifies the impact of the 1% rule.

How Professional Athletes can Leverage the 1% Rule

In a profession where success is measured in fractions of a second or inches on the field, the 1% rule resonates. It’s about allocating just 1% of your resources towards financial goals, a concept that mirrors the incremental gains athletes strive for in their careers.

This rule isn’t just for the financially savvy; it’s a versatile tool designed for athletes seeking to secure their financial future.

Over time this 1% rule can drastically change your future. Unfortunately, because it is such an easy rule to follow, it is also easy not to do it.

Take brushing your teeth for example.

The outcome of not doing this for just a day or two will have no visible impact. However, not brushing your teeth every day this week might cause a slight smell. Over five years, you will need an emergency visit to your dentist.

So how can the 1% rule be applied to the world of investing?

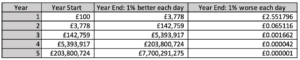

Over time, the difference between allowing something to worsen by 1% each day vs improve by 1% each day becomes extremely significant.

If you start the year with £100 for example and manage to improve that value by 1% each day for 365 days, you will have multiple by a value of 37.

Over ten years, assuming the same 1%, that number increases significantly to £15 quadrillion.

Budgeting and the 1% Rule

Budgeting can be as competitive as a championship game, and the 1% rule transforms it into a winning strategy.

Allocate just 1% of your earnings towards savings and investments, making financial discipline as integral to your routine as training sessions. It’s a simple yet powerful playbook for accumulating wealth in the long run.

With investing, you can start with as little as £1 with certain applications.

So, no matter what your earning potential is, you can kick-start these good financial habits early. Over time, you will be amazed at the levels such an investment can grow to.

Remember – time is your ally with investing. Give compound interest time to work its magic.

Compound Interest: Amplifying the 1% Rule over 10 Years

Now, let’s add a powerful ally to the 1% rule – compound interest. Over a 10-year period, the 1% increment, when compounded, has a snowball effect on your wealth.

The interest earned in each period is added to the principal, generating even more interest in subsequent periods.

This compounding effect can significantly amplify the impact of the 1% rule over time.

Let’s explore a real-life example of how compound interest can work with an initial investment of £50,000 over a 30-year period with a 10% annual interest rate.

Assumptions

Initial investment: £50,000

Annual interest rate: 10%

Interest compounded annually

Year 1

Initial Investment: £50,000

Interest Earned: £5,000 (10% of £50,000)

Total Value: £55,000

Year 2

Initial Investment: £55,000

Interest Earned: £5,500 (10% of £55,000)

Total Value: £60,500

Year 3

Initial Investment: £60,500

Interest Earned: £6,050 (10% of £60,500)

Total Value: £66,550

This pattern continues, with each year’s interest calculated on the new total. After 30 years, the investment would have grown significantly.

Year 30:

Initial Investment: £50,000

Interest Earned (compounded annually): £1,408,581.16

Total Value: £1,458,581.16

This example illustrates the power of compound interest. Over the 30-year period, the interest earned in later years contributes significantly more to the total than the interest earned in the earlier years, showcasing the exponential growth that occurs when earnings generate additional earnings over time.

Keep in mind that this is a simplified example for illustrative purposes, and actual investment returns may vary.

Additionally, factors like taxes and fees and falls in stock markets, which are not considered here, would affect the final outcome.

Incremental Growth and Patience

In sports, the road to success is marked by incremental growth and unwavering patience.

The 1% rule mirrors this principle. It’s not about quick wins but about the cumulative impact of consistent, incremental financial decisions.

Each 1% increment, when compounded, contributes to exponential financial growth over the course of your career and beyond.

Financial Planning and Long-Term Goals

For athletes with aspirations beyond retirement, integrating the 1% rule into your financial playbook is essential. Set and achieve long-term goals by aligning your financial plan with this rule.

Whether it’s supporting charitable endeavours, starting a business, or investing in post-career education, the 1% rule, coupled with compound interest, ensures each financial move is a giant leap towards your vision of success.

Conclusion

In the realm of professional sports, where careers are short-lived and financial landscapes are unpredictable, the 1% rule emerges as a game-changer.

Athletes, just like in their sport, understand the power of consistent effort over time.

Embrace the simplicity of the 1% rule, leverage the magic of compound interest, exercise patience, and witness it transform your financial game.

The playbook for financial success is in your hands – start implementing the 1% rule with compound interest and watch as it propels you towards lasting wealth, on and off the field.